Describe the Reason for This 1099-nec

Check here to request a return by first class mail of all certified copies of documents filed with the court. The US 1099 Electronic Media Report generates now generates Form 1099-MISC as well as Form 1099-NEC as two separate files.

Form 1099 Nec Nonemployee Compensation Definition

You can continue using the same codes as before.

. The IRS also wants to ensure that the organization is worthy of maintaining its tax-exempt status and requires more details on the types of activities it. For example if an employee sends a resume or CV to apply for a job to an employer then the employer has to acknowledge the employee by sending a letter. You forgot to claim the Child Tax Credit.

You received another or corrected W-2 form. Form 1040-X Part III asks you to explain in your own words why you are amending the return. Form 990 initially requires the organization to describe its mission or other significant activities.

Stating the reason for the amended return. The organization must then disclose financial details on its revenues expenses assets and liabilities. They often use words or phrases that might sound funny or awkward or they may 3.

This explanation should describe the specific corrections youre making and can be very brief. The process for entering invoices for 1099 reportable suppliers remains unchanged. You forgot to deduct a.

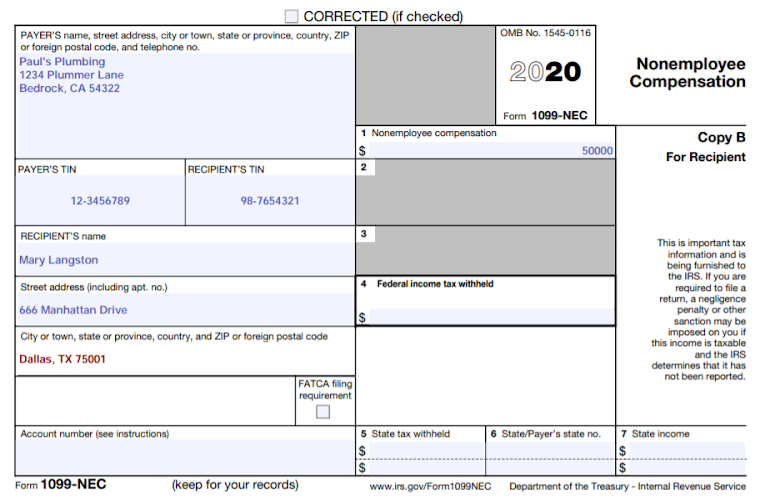

Always put them back. Although a pretty common phrase not everyone is familiar with under the table jobsFor 2018 filing is required on unearned income of more than 2100People who work odd jobs throughout the year must report their incomeThe reason that this gets confusing for individual taxpayers is that the threshold for required reporting from the payor is3152022. Starting from tax year 2020 non-employee compensation is reported in Form 1099-NEC.

If you are exempt from the tax for any other reason you must attach a statement to Form 1040-NR identifying your country of residence and the law and provisions under which you claim exemption from the tax. If you owe this tax you must attach a statement to your return that includes the information described in chapter 4 of Pub.

1099 Nec But Not Self Employed Page 2

Form 1099 Nec Nonemployee Compensation Definition

:max_bytes(150000):strip_icc()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Form 1099 Misc Miscellaneous Income Definition

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Form 1099 Nec For Nonemployee Compensation H R Block

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

Solved Describe The Reason For This 1099 Nec Won T Acce

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Form 1099 Misc Miscellaneous Income Definition

Form 1099 Nec How To File The Forms Square

What Is An Irs Schedule C Form

Form 1099 Nec Nonemployee Compensation Definition

What Is Form 1099 Nec Turbotax Tax Tips Videos

What Is A 1099 K New Rules And How To Use It On Your Taxes

Onlyfans 1099 Taxes How To Properly File

Irs Form 1099 Reporting For Small Business Owners

2021 Form 1099 Nec Explained Youtube

Prior Year Indicator For 1099 Misc 1099 Nec And 1042 S Files Sap Blogs

Really good information and easy to understand. Thanks for helping!!!. Get services of 1099 NEC form

ReplyDelete